Solution: Rotating Accounts

As you know PayPal will eventually request your SSN or EIN to satisfy Tax ID requirements by the IRS. The good news is that this request only happens when you surpass thresholds put in place by PayPal (200 items or 20k gross sales in a year). The easy solution to this is to NOT pass these limits and instead rotate between several accounts (you should be doing this already) as to not hit these limits. If that’s for you then let’s get to it!

1. Stay Organized

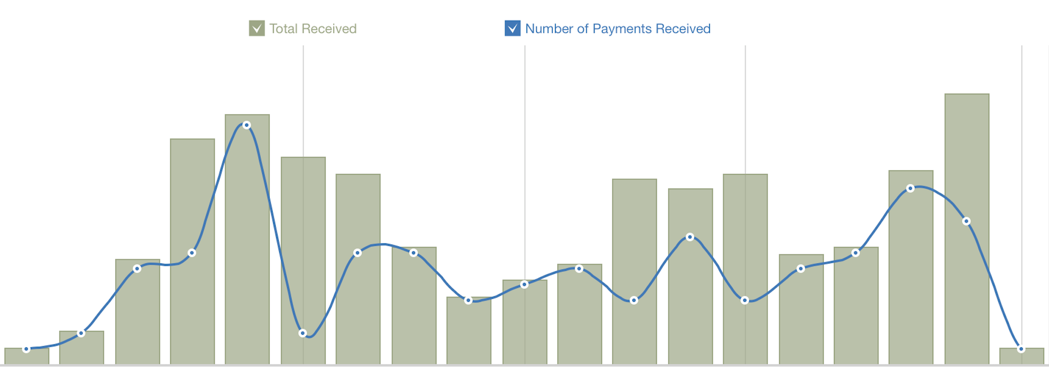

You’ll be able to track your account usage within the reports section of your PayPal account. This will give you a good idea of where you stand with your account. If it’s July and you have 160 sales clocked in then it may be time to switch accounts for the year.

At the very least have 2-3 accounts up and running at all times so if I have trouble with one account, you will be able to easily switch to another account without wasting time.

2. Have Backup Accounts

You want backup accounts.. and lots of them. You’re wanting stealth accounts that you can easily create in mass with little worry about the longevity of the account.

We have some users with dozens of accounts rotated throughout the year.. it’s interesting to watch. Of course this isn’t for everyone so next we’ll cover creating a business account with an EIN. These are accounts that can last a lifetime.

Note: If you stop selling with a PayPal account before it’s Limited pending Tax ID, by January the following year limits are reset (sometimes) and you can continue selling with fresh limits to the account.

Next we’ll talk about business accounts!